posted by Phill Allen

August, 22nd, 2016

Company News Pharmaceutical Industry News

American global pharmaceutical corporation Pfizer confirmed today that it is to acquire cancer drug firm, Medivation, for around $14bn (£10.7bn).

Takeover rumours have doubled its share price in the past six months. Pfizer confirmed the deal on its website on Monday morning.

Ian Read, chairman and chief executive officer of Pfizer, expected the acquisition of Medivation to “immediately accelerate revenue growth and drive overall earnings growth potential”.

San Francisco-based Medivation focuses on rapid development of novel therapies to treat serious diseases for which there are limited treatment options. The firm produces the prostate-cancer treatment Xtandi.

Mr Read added: “The addition of Medivation will strengthen Pfizer’s Innovative Health business and accelerate its pathway to a leadership position in oncology, one of our key focus areas, which we believe will drive greater growth and scale of that business over the long-term.”

Pfizer is set to pay around $81.50 per share for Medivation – a 21% premium on Medivation’s share price as of last Friday.

TAGS:

Medivation, Pfizer,

SHARE:

Author

Phill Allen

Managing Director

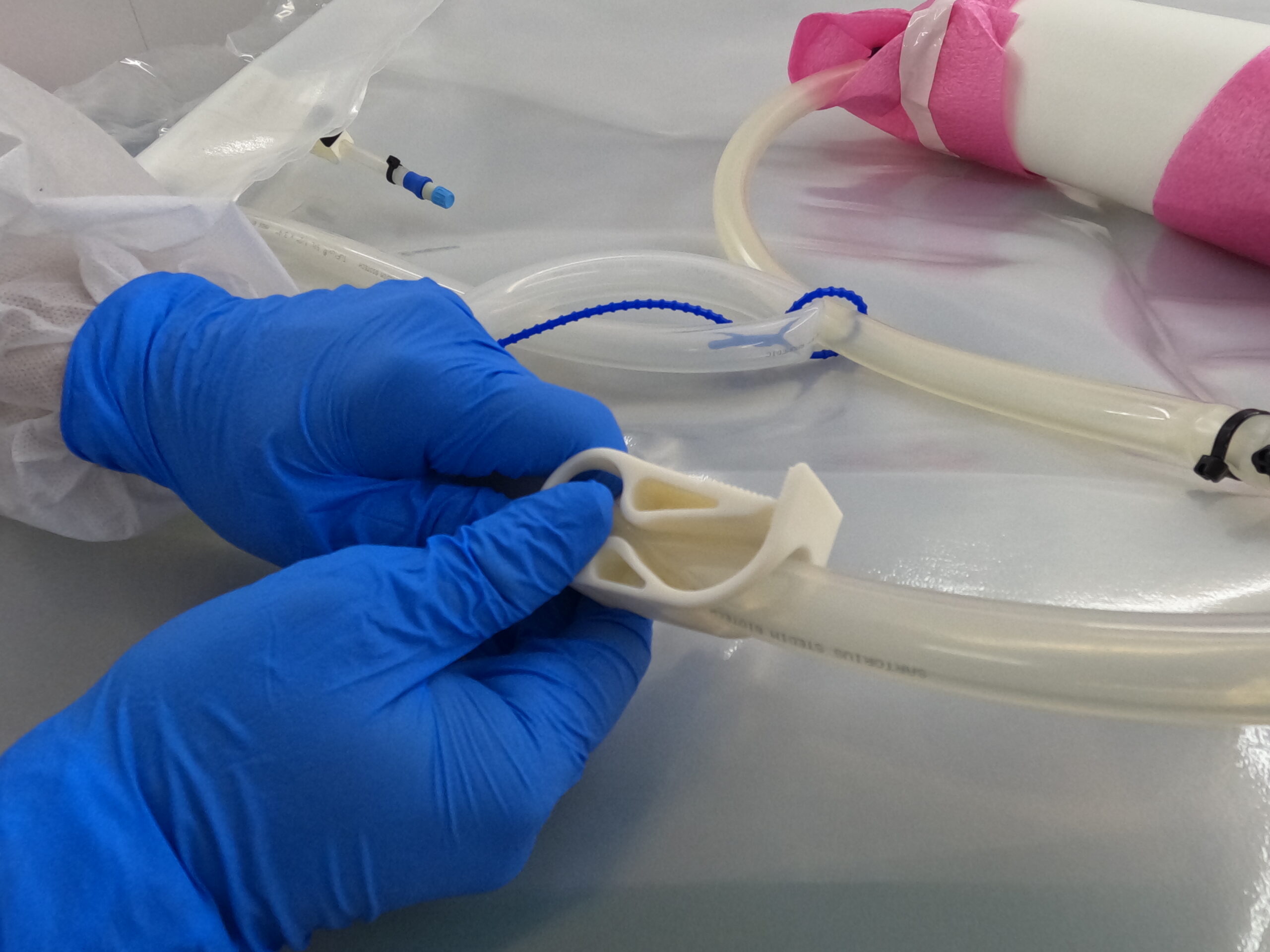

Phill is an innovative thinker particularly in fluid management. His expertise lies in ensuring the seamless flow of pharmaceutical liquid logistics, whether it's optimising current processes or pioneering new approaches.